Paying nanny taxes in California includes payment to the IRS for federal taxes as well as payments to California’s Employee Development Department (EDD).

Initial Setup

- Register online for a Federal EIN (Employment Identification Number).

- Create an account with California EDD, which will be used for California specific filings. Use the “Enroll” button under e-Services for Business to create a user name and password.

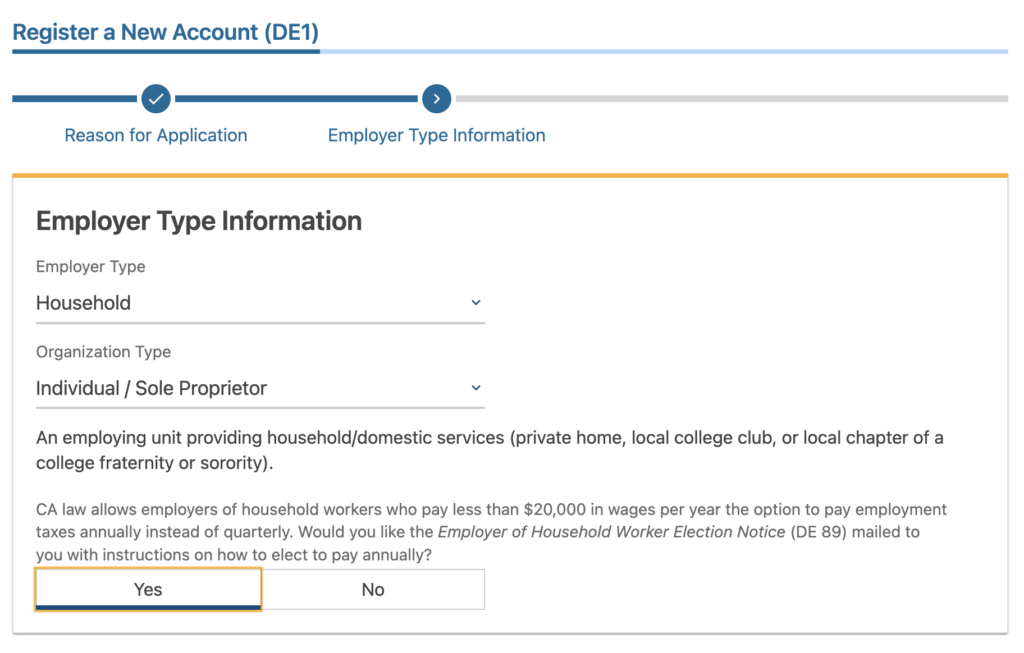

- Once you have paid $750 or more in a quarter, you must register with the state of California for an Employer Payroll Tax Account Number. To do log in using your e-Services username and password created in the previous step.

- For “Reason for Application”, select “New Hire”. The following page will prompt you for “Employment Type”, where you can select “Household”.

- If you plan to pay $20,000 or less a year to all employees, you can elect to pay once a year, rather than quarterly. In this case you will be considered an “Annual Payer” rather than a “Quarterly Payer”

4. If you and your nanny agree to withhold income tax, have your nanny fill out forms W-4 and DE 4 for withholding elections.

5. Register online with the Social Security Administration. This will be needed to create a W-2 for your nanny in January.

6. Form I-9 is used to verify that your nanny is legally able to work in the US. You do not need to submit this form but must retain it in your records.

Each pay period

Each pay period the person you need to pay is your nanny. Pay her the Net pay amount via cash, check, or direct payment initiated from your bank.

The taxes will be remitted quarterly or annually.

Paying California Taxes

Report wages and California taxes quarterly and pay online using e-Services for Business.

| April | Report wages and taxes for Jan – March by April 30. If you are a quarterly payer, you will also pay at this time. |

| July | Report wages and taxes for April – Jun by July 31. If you are a quarterly payer, you will also pay at this time. |

| October | Report wages and taxes for July – Sept by Oct 31. If you are a quarterly payer, you will also pay at this time. |

| January | Report wages and taxes and pay for Oct – Dec by Jan 31. Both quarterly and annual payers will pay at this time. |

The CA taxes are SDI (State Disability Insurance), ETT (Employment Training Tax), UI (Unemployment Insurance, shown as SUTA on pay statement), and PIT (Personal income tax, shown as CA Income Tax).

For quarters that you do not have wages, you must still file the report. You can close your account if you no longer plan to have any employees.

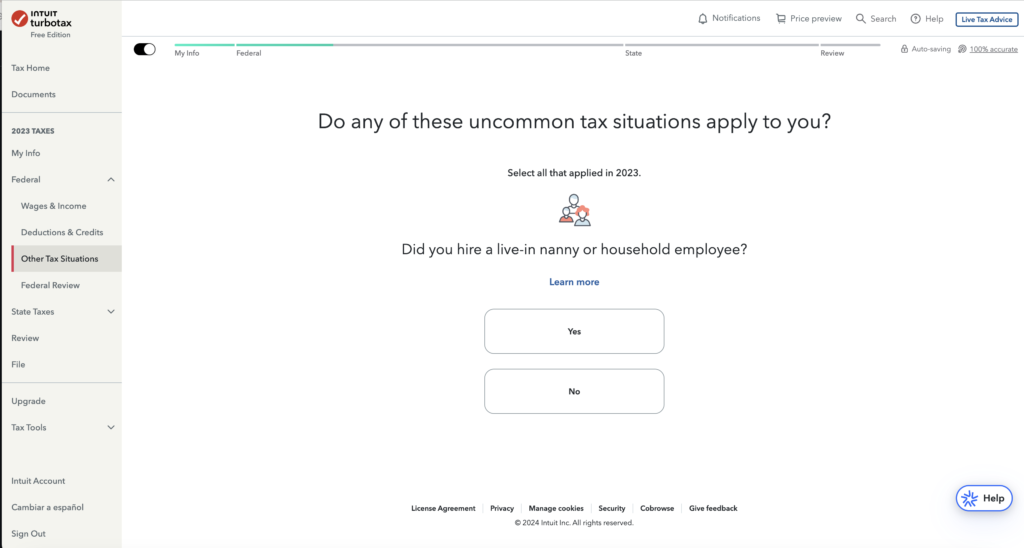

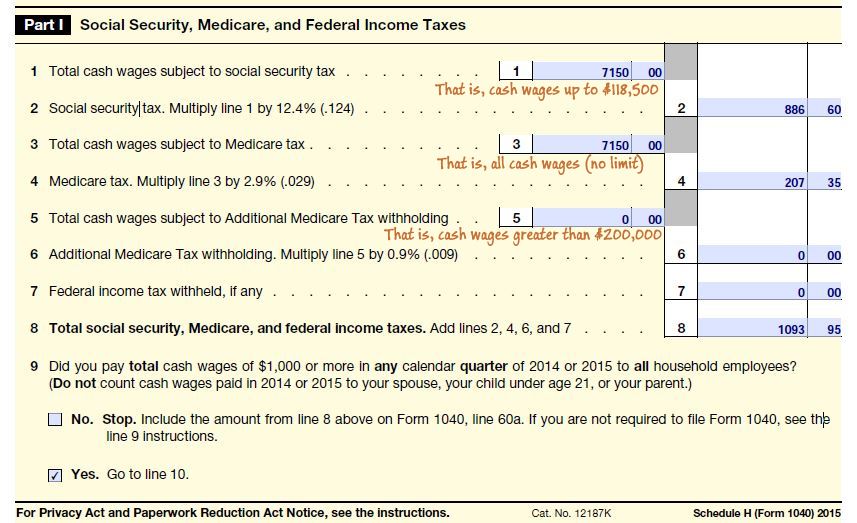

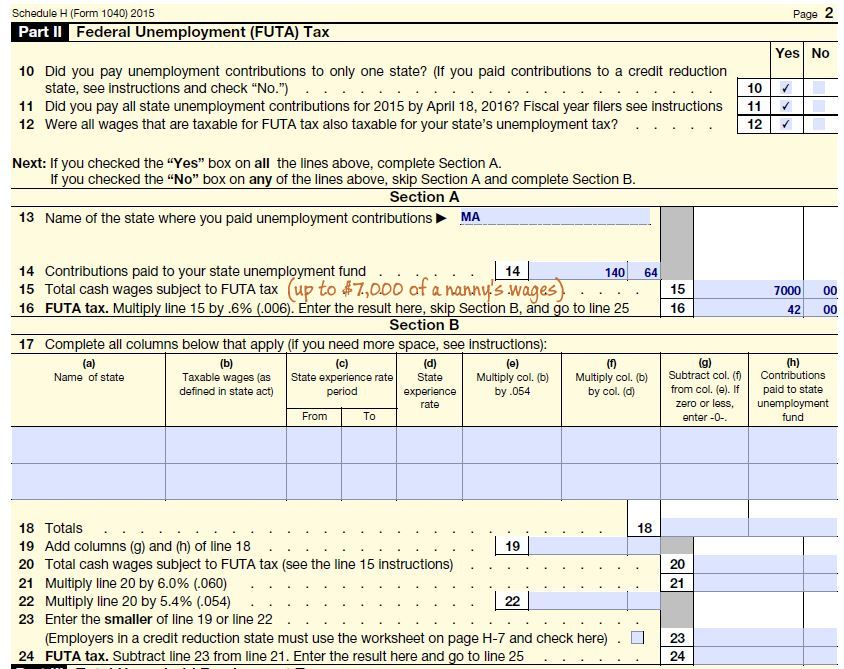

Paying Federal Taxes

The federal taxes are Social Security, Medicare, Federal Unemployment (FUTA), plus any income tax withheld from your nanny’s pay.

The balance of those federal taxes is paid with your personal income tax return due April 15, by adding Form Schedule H.

However, if the amount of taxes to be owed over the course of the year is greater than $1,000, you should pre-pay the IRS along the way to avoid a tax underpayment penalty. There are a couple of ways to do this:

Option 1 – Update your withholding: If you are a W-2 employee, you can update your own W-4 election with your employer to have the additional tax amount withheld from your pay.

- For the example pay statement in the previous section, the household employer can request an additional $63 (employee + employer portion of SS and medicare + federal income tax withheld) withheld each week from their pay. This amount gets paid to the IRS on their behalf by their employer.

Option 2 – Pay Estimated Taxes quarterly: You can alternatively make Quarterly Estimated Payments to the IRS yourself by April 15, June 17, September 16, and January 15. The DirectPay option allows you to quickly pay without creating an account, while creating an account will allow you to track previous payments. EFTPS is another option geared toward businesses but also can be used by individuals who wish to schedule all payments for the year.

Note that the amounts pre-paid are a best estimate. Form Schedule H will determine the exact amount owed and reconcile any differences.

Annual – Creating a W-2 for your nanny

As a household employer, you will need to provide your nanny with a W-2 by January 31 for the prior tax year.

A W-2 can be created and filed using the online tools from the Social Security Administration, which will contain both the federal and state information she will need in her own tax return.

Details on how to fill out Form W-2 is found here.

Worker’s Compensation Insurance

California requires employers to carry Workers’ Compensation insurance. This is separate than CA and federal taxes, and not reflected on the pay statement.

Follow the payment schedule required from your insurance provider for this.